extended child tax credit dates

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. For the tax year 2021 the Child Tax Credit is increased from 2000 per qualifying child to.

Arizona Families Now Getting Monthly Child Tax Credit Payments

150000 if you are.

. The expanded child tax credit includes up to 3600 per child under age 6 and 3000 per child ages 6 through 17. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per. The maximum child tax credit amount will decrease in 2022.

The US Tax Filing Deadline was April 18 2022. 13 opt out by Aug. The Child Tax Credit is a federal tax credit that reduces the amount of federal taxes owed by a taxpayer by 1000 for each child under age 17.

For parents who opted out of the advanced child tax credit payments in 2021 they will be able to claim the full credit if they qualify on their 2021 tax return. 15 opt out by Aug. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get.

This money was authorized by the. Your amount changes based on the age of your children. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to.

Get Your Past-Due Taxes Done Today. Here are the bank. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021.

The child tax credit is an annual tax credit available to taxpayers with qualifying dependent children. While the IRS did extend the 2020 and 2021 tax filing dates due to the pandemic you. The legislation made the existing 2000 credit.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Here are the child tax benefit pay dates for 2022.

Now if the current. Can families determine how the credit. The last round of monthly.

In 2017 this amount was increased. While the IRS did extend the 2020 and 2021 tax filing dates due to the pandemic you typically have from the end of January to April 15 to file. Besides the July 15 payment payment dates are.

Complete Edit or Print Tax Forms Instantly. Taxpayer income requirements to claim the 2022 child tax credit. 3600 for children ages 5 and under at the end of 2021.

In 2021 and 2022 the average family will receive 5086 in coronavirus stimulus money thanks to the expanded child tax credit. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous.

Families will see the direct deposit. The credit amount was increased for 2021. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Here are further details on these payments. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. And 3000 for children ages 6 through 17 at.

Previously the credit was 2000 per child under 17 and will revert. New 2021 Child Tax Credit and advance payment details. Child Tax Credit amounts will be different for each family.

However if parents alternate claiming each year both parents may receive the child tax credit this year.

What Families Need To Know About The Ctc In 2022 Clasp

Four Reasons The Expanded Child Tax Credit Should Be Permanent Rwjf

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

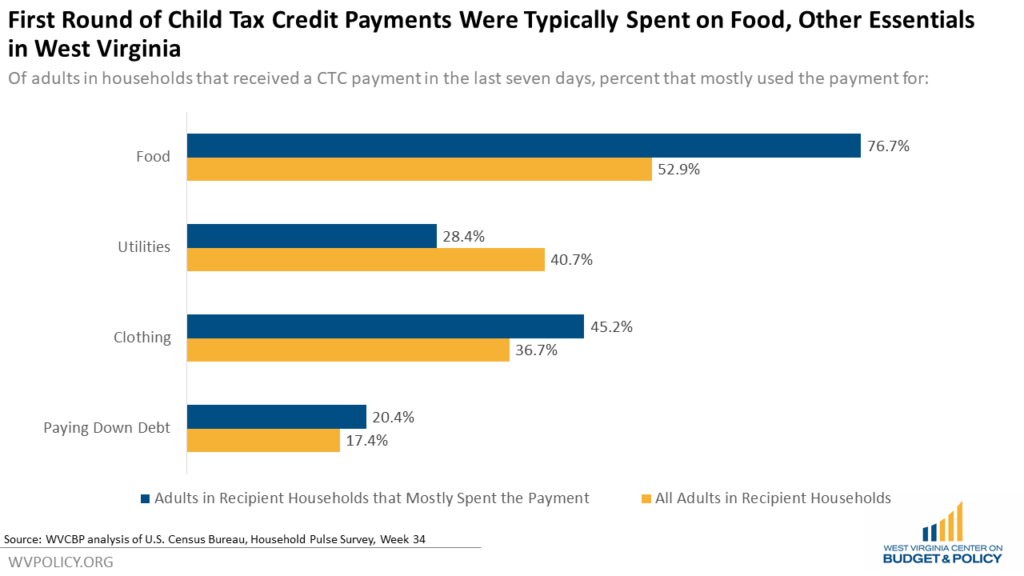

The Enhanced Child Tax Credit Is Helping West Virginia Families Invest In Child Education And Care West Virginia Center On Budget Policy

06 21 2021 Child Tax Credit Panel With Experts Youtube

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

Expanded Child Tax Credit Available Only Through The End Of 2022 Cbs Los Angeles

Parents Guide To The Child Tax Credit Nextadvisor With Time

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

City Reminds Parents To Take Advantage Of Child Tax Credit

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Don T Miss Out On The Expanded Child Tax Credit Advocates For Ohio S Future

Stimulus Update Last Child Tax Credit Payment In December Important Deadline Ahead Al Com

Biden Touts Expanded Child Tax Credit Abc News

The Impacts Of The Child Tax Credit Now And In The Future Kentucky Youth Advocates

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)